Don't all Americans disapprove of Trump's subservience to Bibi?

Time To Rise Up Against Establishment - "Working with new media channels around the world to start a revolution."

Sorry but this is BS though. For example, it includes Emily Schrader, a hasbara activist? 😆

Not if the node stays online, which it's supposed to. A 20M channel is no big deal and you can have lots of them. There is really no limitation

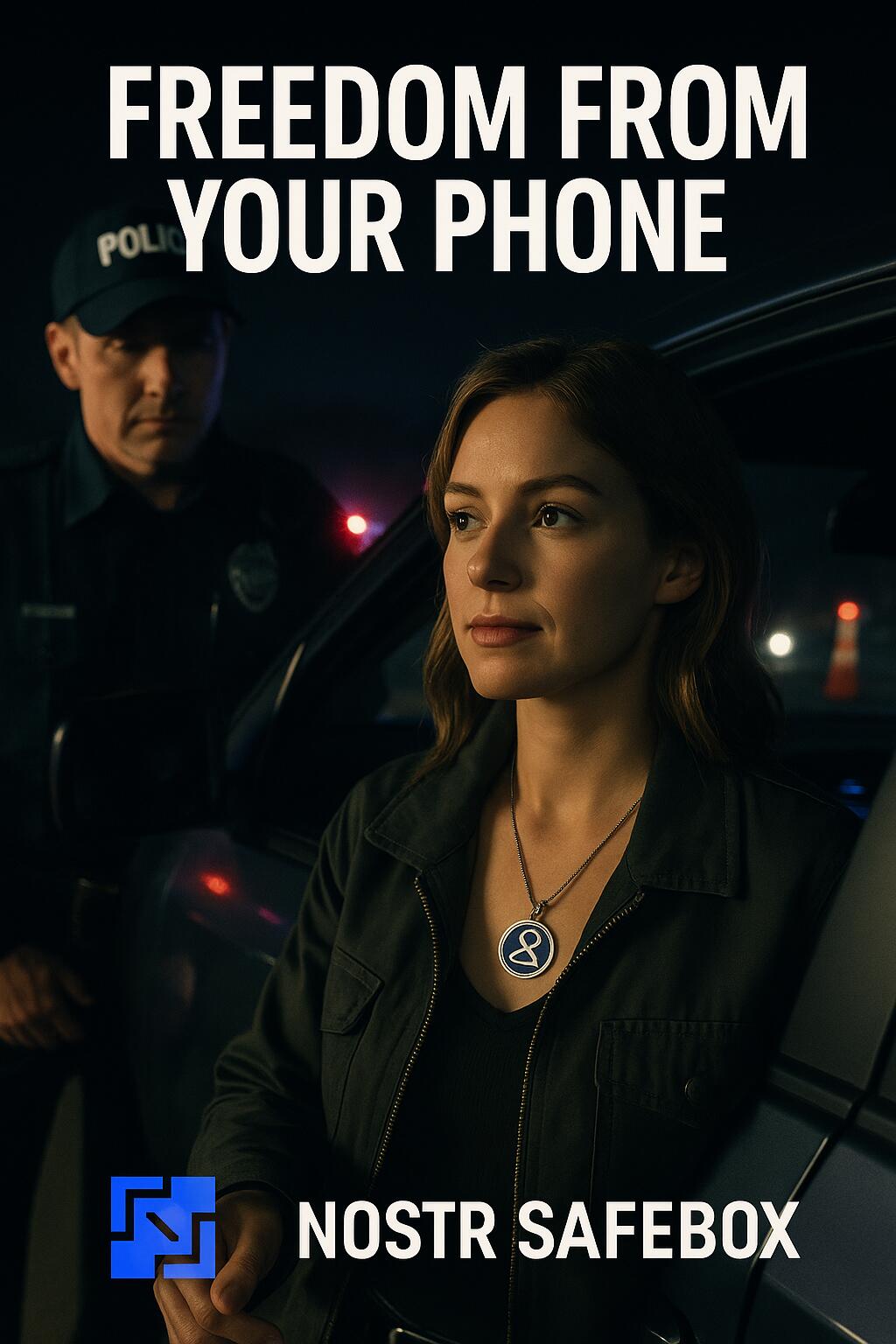

Intriguing, but wouldn't the cops just steal the pendant?

Does using Ubuntu Pro have privacy implications?

#asknostr

They are spreading like a cancer around the world. I say this because they are bribing local officials and establishing exclusionary racist colonies.

Childless friends be like

https://blossom.primal.net/6e9992f6bb5e2b10b11028e4fafbee68b74f35c0f187961cf231899107707d87.mp4

Why? A 2M sat channel is no problem

You need to set up zaps

Question is what are they going to do about it

I could not zap you. Can you please set up zaps? Something like nostr:nprofile1qqstxwlea9ah3u6kjjszu6a7lrnhqkfh8eptp2z6v0e9558tlkkl2rgpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhszxnhwden5te0wfjkccte9ekkjmnfvf5hguewvdshx6p0qythwumn8ghj7un9d3shjtnswf5k6ctv9ehx2ap0wsvavr is very easy to set up and use for zaps

These comments are on point. I can't zap you

This is the way, works great on a cheap M1 or go bigger with a PC + graphics card(s)

MapleAI is an implementation of secure servers to demo their abilities. It is the real innovation that I hope they continue to develop into a general purpose secure private server solution. It is described how to verify it and I see it but I don't know enough to go all in believing it until I see more use cases

He got played by Israel, they have no intention of stopping, since nukes were just an excuse. They don't need another one now that the war is underway

Israel Targets Iranian Nuclear Scientists Along With Their Families

From Sputnik

The Israel Defense Forces (IDF) launched Operation Rising Lion in mid-June to target Iran’s military and nuclear facilities. The Israeli strikes also killed an array of Iranian nuclear scientists and their dear ones.

Jun 24th 2025 6:27am EDT

Source Link: https://sputnikglobe.com/20250624/israel-targets-iranian-nuclear-scientists-along-with-their-families-1122330740.html

Share, promote & comment with Nostr: https://dissentwatch.com/boost/?boost_post_id=992137

War crime!

The number one exporter of terror is Israel. Israel also happens to be the number one exporter of anti-Islam propaganda that Western media parrots unquestioningly.

Both sides are not as bad as each other. Israel is way worse, they're the ones with the terrorists, the ones doing ethnic cleansing, and bombing their neighbors.

The explanation seems like a lot to digest for a noob. Could maybe the channel opening be combined with the Alby payment? With an explainer that the payment will be subtracted from the funds?

Perhaps you meant ecash and not lightning network, but even then, there is a world of difference when compared to the legacy banking system.

I would recommend against both proton wallet and proton VPN. The other proton services are fine - they are private but not anonymous unless you are very careful about opsec.

If you have some sats you can consider using custodial ecash which can be set up in about 1 minute nostr:nprofile1qqstxwlea9ah3u6kjjszu6a7lrnhqkfh8eptp2z6v0e9558tlkkl2rgpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhszxnhwden5te0wfjkccte9ekkjmnfvf5hguewvdshx6p0qythwumn8ghj7un9d3shjtnswf5k6ctv9ehx2ap0wsvavr

That's just more confusion

If you were blackmailed by Mossad you would probably bomb Iran too. The fact that no one will give us the Epstein list means it’s literally all of them. I’ve been saying for a while now that Trump would end up being the right wing version of Obama. Obama ran on “change” and all we got was more spending and more desert wars. Trump ran on draining the swamp and all we’re getting is more spending and another desert war.

https://blossom.primal.net/a8a9263b19abfe20403cffdffb08b05f439ba1738f869761aa99c49487cccc74.mov

What is Trump dropping in there? Is it a real video?

Wishful thinking has me believe that Trump bombing Iran against the vast majority of Americans' wishes will wake some of them up

Terrorism plays a key role in spreading communism, so I don't think you're making the point you think you are.

In the case of Israel, they are the terrorists.

Do you have a screenshot, I can't access gab

That's nothing compared to what the government steals from them

Nobody pays fuckin tax on their zap income anyways unless they're retarded

Yes, that is an effect of corporatism: government captured by corporations to mandate their products.

Netanyahu Prepares Full Scale Assault on Gaza

From Infowars

Most of Gaza has already been leveled, but Netanyahu says he seeks to “complete the job” and “go all the way.”

May 13th 2025 6:54am EDT

Source Link: https://www.infowars.com/posts/netanyahu-prepares-full-scale-assault-on-gaza/

Share, promote & comment with Nostr: https://dissentwatch.com/boost/?boost_post_id=969008

The world is watching

100% of government money is stolen so there's also that

Turn it around and try them for the crime of hiding evidence. These people need to be tried for their crimes or they will keep committing them. These are not victimless crimes and we must demand justice.

Europe fails by unifying itself into a giant unelected socialist authoritarian regime

For clients that can handle nevents directly

My guess is it was during his 2012 presidential run. It would be more epic if it was today.

It's Ron Paul

Credit to Dutch Libertarian for the edit

https://video.nostr.build/52f8fa03dce81a2cff65115cdff22a98888ef9946f4f82d167d3e600e3bf3506.mp4

When was this speech?

Not mortgages and credit cards and car payments. Earlier generations (in America at least) did not need them when the money was less inflationary.

Fiat is broken by design