Você percebe que os blocos órfãos são um fenômeno normal em qualquer blockchain, até mesmo bitcoin, correto? 🤪

nostr:nevent1qqstdtq9n7a8hewry53qj8xle3xhwxnqjzew3ruhx3dju6zahv9htdsk3y6n6

1) % Dos blocos órfãos são convenientemente cortados da imagem (coisa normal para ocasionalmente acontecer em qualquer blockchain).

2) Observe quantos blocos acontecem entre qualquer bloco órfão (blocos amarelos).

3) Finalmente, perceba que o hash desconhecido inclui mineradores solo e outras piscinas desconhecidas - não apenas Qubic. Eu posso te ensinar como criticar adequadamente Monero, irmão, mas isso não é slam dunk que você acha que é 😂

Come on now zero drawbacks? Everything has drawbacks.

Well, let's start off with Liquid. No sender or receiver privacy (only amount privacy), virtually zero anonymity set because no one uses it, no p2p markets/merchant adoption, and custodial. It's a worse Monero on almost every dimension, besides longterm price, but if you care about that why not just hodl Bitcoin securely?

UX on Lightning sucks. Inbound/outbound liquidity is unintuitive and clunky. The larger the payment the more likely it is to fail at routing. To acheive strong privacy (from both counter parties and third parties) and actually retain sovereignty you have to jump all these hoops which is why vast majority use custodians or LSPs that diminish your privacy, permission your transactions, and the former can rug you.

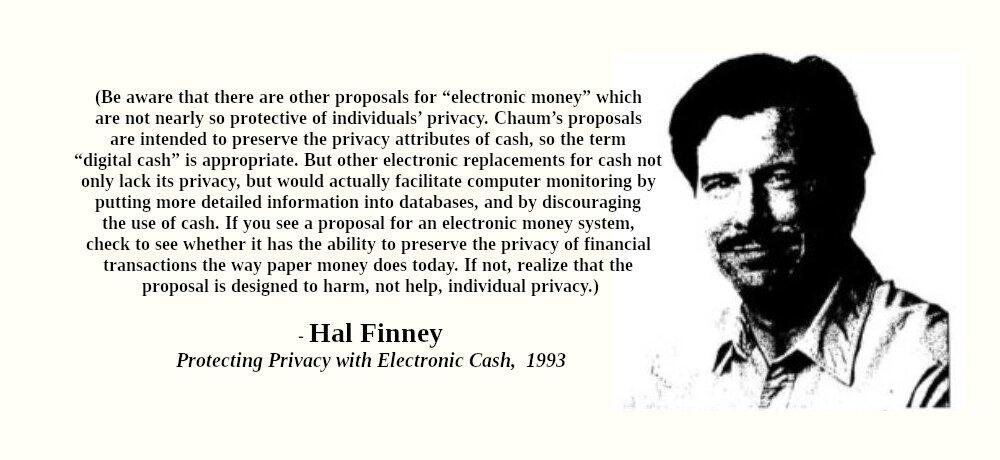

"Civilization is the progress toward a society of privacy. The savage’s whole existence is public, ruled by the laws of his tribe. Civilization is the process of setting man free from men."

- Ayn Rand, The Fountainhead

Liquid and Lightning have different trade offs to Monero, but if it works for you more power to you. There is nothing mutually exclusive about saving with Bitcoin long term, as you said, and using something else as digital cash for the short term. It's been a toss up at shorter time scales as to which performs better.

> What's more important: fast wealth or privacy?

Sound money is what's important. Privacy is too, but is mutually exclusive with the ability to audit the blockchain, which supports confidence in its soundness. The only way you can get both is through a second layer solution (or maybe by proving your system doesn't have an inflation bug, which is hard with asymmetric cryptography).

Also, my understanding is that monero has scaling limitations just like bitcoin does, which means transactions may not always be cheap. Monero's privacy is also not an absolute guarantee. This podcast was very good on understanding how difficult privacy and scaling are: https://fountain.fm/episode/1LiBxWAojDCBm1pGFhGd

Monero scales worse in regards to resources to run a node vs Bitcoin. But it scales better than Bitcoin in regards to number of transaction and transaction fees because of dynamic blocksize. More transactions =/= higher fees on Monero.

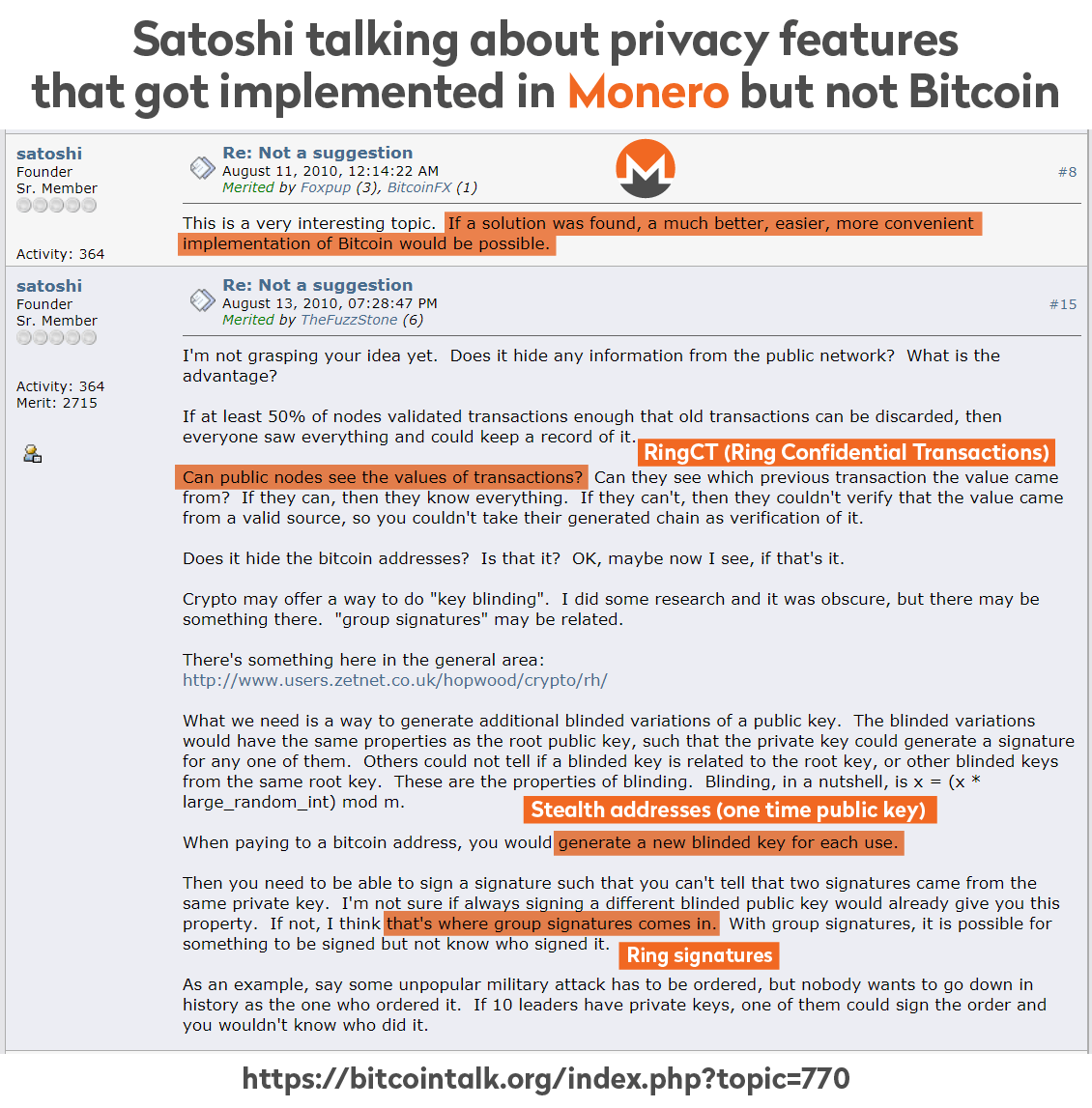

FCMP++ upgrade is well in motion and will fix Moneros relatively weaker sender privacy with ring signatures discussed in this podcast. Amount and receiver privacy is already very strong.

nostr:naddr1qvzqqqr4gupzqun2rcnpe3j8ge6ws2z789gm8wcnn056wu734n6fmjrgmwrp58q3qq3h5ctswd6x7un995kj6mmsv4h8xct5wvkhqun0vaex2umn94ex2ur0wf6qpne98p

Black markets and parallel economies. Both which become larger the more restrictive government becomes.

Nice clickbait articles that are taking the word of a single shitcoiner (who you wouldn't take at their word, with no evidence, in any other scenario), but I'm asking you to point it out directly through known pool hashrate, leftover unreported hashrate, or orphaned blocks.

It doesn't exist and didn't come anywhere close to what Qubic was claiming even before the supposed DDoS. You can verify yourself with my previous links.

neither. for private BTC payments use Liquid or Lightning. Monero is a shitcoin with high risk of 51% attack. https://www.btcc.com/en-US/square/BTCX7/706423

Trying to find the Qubic 51% attack can you help me out?

I am not adding litecoin, cardano or monero. We have bitcoin and stables, to add the rest would be uncivilized.

- nostr:npub1vtlqystr2056cqvuy8uehq5g757362029krqv5axw6gdw37kunkq7ajrhd

#BitcoinTwitter

Funny how things change. He added all three of those to Noones.

Il n'y a pas de problème, c'est tout du show et du marketing de Qubic

"Accrescent depends completely on donations to run. Today we share a significant update in our new blog post on the future of Accrescent."

https://xcancel.com/accrescentapp/status/1952410172812677174#m

https://blog.accrescent.app/posts/the-future-of-accrescent/

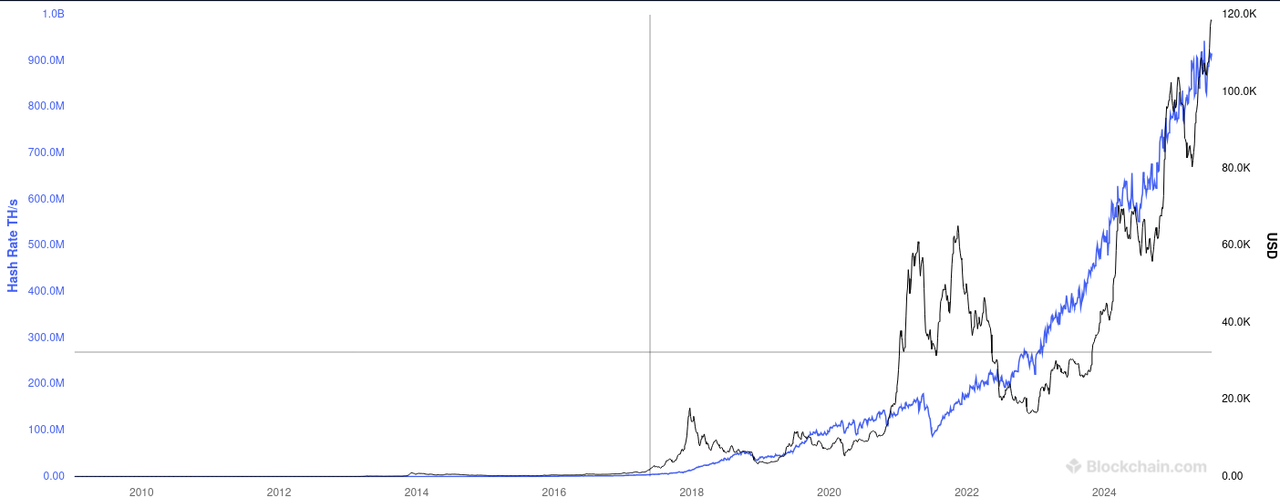

"Rough draft of Rucknium's web app for Monero consensus monitoring: moneroconsensus.info/ #xmrconsensus

Tracks pool data (via DataHoarder_'s git.gammaspectra.live/WeebDa…) for malicious signs: selfish mining (high honest orphan rates) & double-spends (deep re-orgs as alt chains)."

https://xcancel.com/MoneroResearchL/status/1951659427737546919

Monfluo 0.8.1 release

Monfluo a pure Monero wallet for Android.

-Update Monero to 0.18.4.1

-Properly detect and display tor/i2p icons for nodes

-Update NDK, this should make the app support 16KiB pages

>"In monetary economics, the predictability of a currency's supply does not inherently ensure its efficacy as a store of value."

I didn't claim this. My point was a similar one. Just like predictability, less supply or capped supply does not necessarily = scarcer. You're completely ignoring the other side of scarcity which is demand.

If there is a supply of one, yet no one demands it, there is no scarcity. Similarly if a good has a smaller capped supply that is less demanded, and another good has a larger continuous supply with much more demand, the latter can be more scarce at any point in time than the former.

>"This makes it a superior alternative to gold, which is prone to capture and supply shocks, fiat, which suffers from centralized overissuance or any ever increasing commodity, even if the increase is predictable."

Those are disadvantages yes, but you're ignoring other advantages gold has over Bitcoin (fungibility, privacy, network effect, wider acceptance, independent of digital infrastructure, longer proven history as SoV, physical, doesn't cease to exist without miners, etc). What properties people value more than the other is subjective.

>"...even gold, which can see supply shocks from new mining tech or discoveries"

Threats from new technology apply to Bitcoin as well if not more so. Easy example is the threat of quantum computing potentially breaking it along with what that would do to confidence in it as a SoV

>"Bitcoin’s hard cap is coded into its protocol, making its scarcity absolute and predictable."

Capped supply, predictability, or code alone can't enforce SoV - a network of people must be in consensus with it. If that network dilutes with growing "normies" that become the majority, and government entices them with carrots and sticks down the road to move their money to a fork, with a supply controlled by the state, the smaller "original" network might still exist, but there goes the SoV narrative.

Recent crypto payment stats for Coincards and NanoGPT

Not even sure what point you're making

I'm saying theres only a handful of Monero bros on Nostr

Monero users tip with both Lightning and Monero. You just don't see the Monero side because it's not shown to the public and you don't have a Monero address on your profile

Eu sabia que isso te deixava feliz por acreditar, mas nunca houve um ataque de 51%; foi uma jogada de marketing de altcoins.

https://miningpoolstats.stream/monero

Então está a dizer que a Liquid abdica da autocustódia, o objetivo do Bitcoin.

Mas ainda bem que chegamos ao ponto de admitir que o Liquid não é uma ferramenta de privacidade tão boa como o Monero. Então, lembre-me por que razão está a utilizar uma "ferramenta de privacidade" inferior se a está a utilizar apenas ostensivamente para privacidade?

Porque não usar uma ferramenta de privacidade melhor?

They lose the trail as soon as you swap. They won't even necessarily know you swapped to Monero in the first place depending which of those you use. But even if they do that's where their knowledge ends.

If convenience is your priority, you would be using KYC exchanges to get Bitcoin anyway. Not that I recommend doing that.

nostr:naddr1qvzqqqr4gupzqndled79mkuzf8uu06uvy8spnuy0h7m7ch0d2sytv9zep04c6954qqgrgc33v9nxydpnxqmnzdtrvscx2vhut8t

Yes, but the whole point of lightning is to very rarely open/close channels and mostly transact over lightning.

For once we agree on something

Gold did it for thousands of years with a small bit of inflation

You don't need to introduce inflation, but you have to do something if you want to avoid the security problem when block rewards run out.

Relying on price to go up forever, and at the same rate as the past, to secure Bitcoin is very risky to say the least

You're the one assuming price will rise forever. That's a big assumption.

Past performance is no guarantee of future performance.

All you have are claims and speculation. Didn't even try making an argument.

Didn't mention privacy coins once, but glad they're on your mind.

Instead of shouting "propaganda" and "fake assumptions" maybe address a single point in the link?

Thats nice but block rewards get lower over time and run out. Look at current fees. It's unsustainable unless price goes up forever and/or fees continue to rise. Speaking of assumptions, those are big ones to make.

"I didnt read it, but let me critique everything about it except the arguments" 🤪

A Pixel with nostr:nprofile1qqs9g69ua6m5ec6ukstnmnyewj7a4j0gjjn5hu75f7w23d64gczunmgpz4mhxue69uhhyetvv9ujumt0wd68ytnsw43q4gnztg is far more secure than some other device with LineageOS. Just 'removing' Google doesn't improve your privacy or security, it just restricts what Google know about you and will almost uncertainly leave your device vulnerable.

True, but if your goal is privacy and the choice is between an old phone you can install LineageOS on VS stock android I would go LineageOS all day

The most private and anonymous cryptos that DNMs and irl black markets adopt will be king. Logical conclusion if we assume an increasingly hostile stance from governments.

monero idiots be like "its not about money its about sending a message". the message: i'm poor now 🤪

Were these guys idiots

*If you ignore that third party hops see transaction amounts

**If you ignore the vast majority of the network using custodians and LSPs

Two completely different hashing algos. Makes no sense to directly compare.

que não é considerado a mesma coisa?

Being the most saleable good is literally what makes something money or not lmfao. What you're describing is called speculation. Every trade that doesn't involve money is bartering that currently includes Bitcoin and might always.

Both basically their own attempts at a private/anonymous Ethereum

DarkFi is Amir Taakis project it isn't officially out yet. Still in alpha I think. They have the "worlds first fully anonymous chat" you can use but still very early stuff.

Beam has been around since 2019. It is similar to Tari in that it is built on MimbleWimble, so no amounts or addresses visible, but it also combines that with Lelantus (shielded pools) to avoid revealing the transaction graph which is a weakness of normal MW. Very strong privacy and scalability.

Most abused quote in Bitcoin. Not asking for you to convince me. I'm just stating facts for others reading through this.