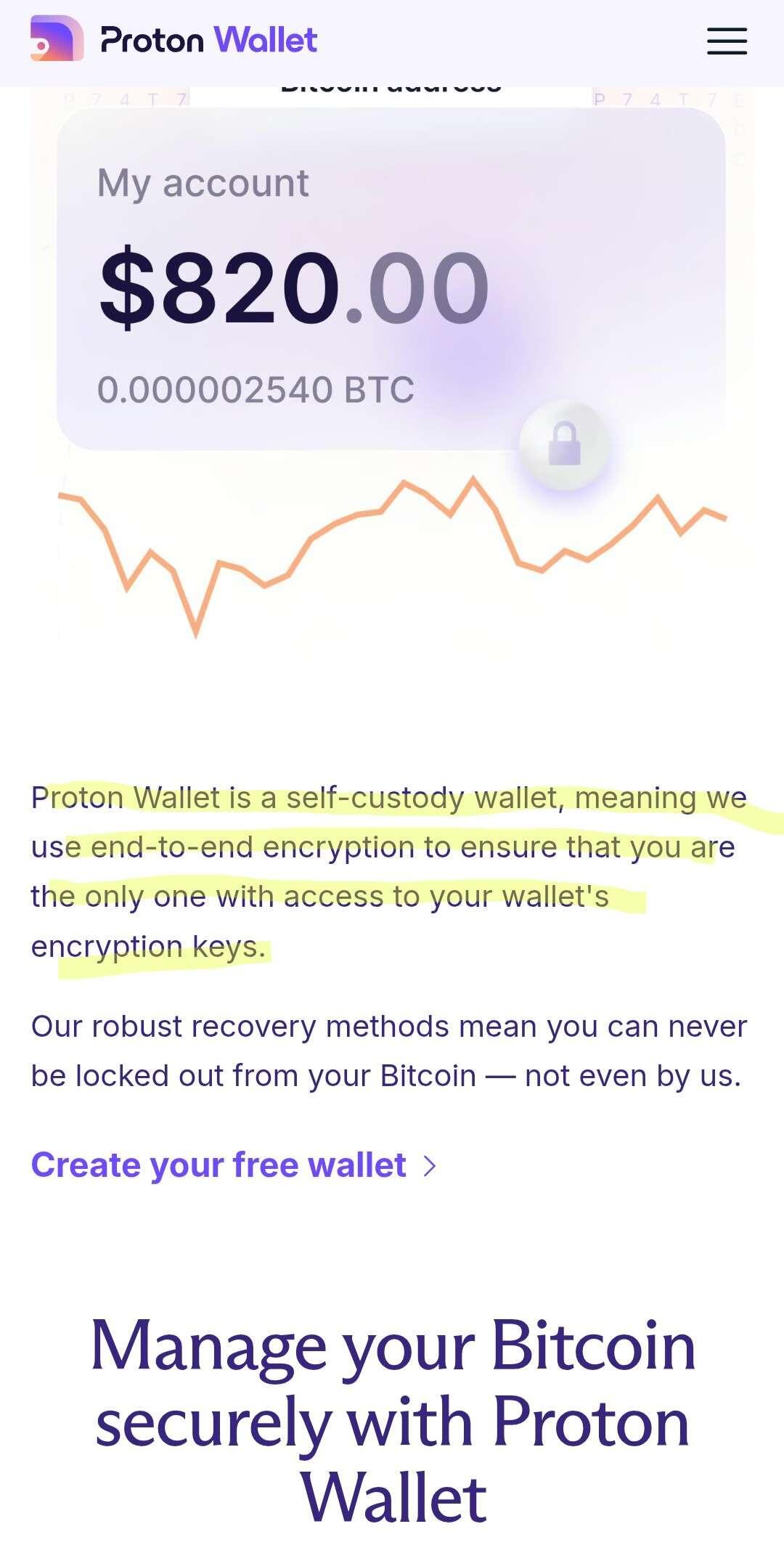

They encrypt your seed with your password and decrypt it when you log in. It works the same as the other Proton apps basically.

IMO the gold flow is more about front running potential tariffs than capital flight. Basically the threat of tariffs means gold in the US is trading at a premium, because it may be cheaper than importing soon, and this is creating an arbitrage for exporting gold to the US.

I don't use auto updates in Obtainium either personally, I like to do it manually

My currently favored setup is KeePassXC on desktop, KeePassDX on mobile, and sync the vault with Syncthing. This is offline but still syncs p2p, works like a charm. But I've also used hosted Bitwarden and Vaultwarden, they're also great. Can't go wrong with either option really.

The world's largest drain is part of the Monticello Dam in Lake Berryessa, California. Known as the Morning Glory Spillway, this massive structure helps manage water levels and prevents flooding by channeling excess water from the lake.

https://video.nostr.build/1c5dc45a8e59a01a231e2623232f8223d5ffa350b552437b7794a6a39ae30c2e.mp4

Minor correction, it's A morning glory spillway, not THE morning glory spillway, it's not a unique structure to this dam. There's this video that explains a bit about how spillways work:

I own some Yubikeys and use them as a 2nd factor authentication option, they're arguably the most secure form of 2fa. See here for motivation:

https://www.privacyguides.org/en/basics/multi-factor-authentication/#fido-fast-identity-online

It's also a bit more convenient to identify with a permanently plugged in USB-A Yubikey than a TOTP app in my opinion.

I wouldn't want to replace my password manager with them though as as some other people pointed out here you're locked into the passkey provider. So Yubico in this case.

Also make sure to add several Yubikeys or TOTP as a fallback wherever you use them as 2nd factor as you can't export the key and you will be locked out if you lose the one key.

To see through this from a libertarian perspective you'd need more of grounding in monetary history / Austrian economics - Then you'd understand that even under a free market of money, the market will converge on one or at most two forms of currency. People prefer to sell their goods and services for THE MOST salable good, not the 3rd most saleable for reasons that should be pretty obvious.

Or in other words: There is no second best. 😁

“It is difficult to get a man to understand something, when his salary depends on his not understanding it.”

― Upton Sinclair

I'm happy I moved here for a number of reasons, but the based electorate definitely helps 😁

Ah so that's why people keep asking "wen lambo?" all the time 😁

The EU can be "regulatory leader" of generative AI made overseas 🤡

IIRC nostr:nprofile1qy2hwumn8ghj7un9d3shjtnyv9kh2uewd9hj7qg3waehxw309ahx7um5wgh8w6twv5hszrnhwden5te0dehhxtnvdakz7qgkwaehxw309ajkgetw9ehx7um5wghxcctwvshsqgysty8dcfrmzq8j8pu6gy4kv9kxt6r543usvy9pte4ny4ap3kdwgvgwfahg said a few months ago that in-kind was not necessarily off the table for the future, it was more a particular set of circumstances around getting listed that led all the ETF providers choosing cash redemption.

Basically after IBIT got approved it was a race to also get approved, as not being live on the go date would lead you to lose market share. And IBIT had cash redemption, so as to minimize differences to the already approved fund everyone went cash redemption. This all to avoid any delay or complication in getting approved by the X date.

So it's not that it's banned by the SEC, or the funds don't want to offer it, it's more that they went live on cash redemption only basis to get approved faster.

The Bitkey is easy to use, good to recommend as someone's first hardware wallet. The Coldcard Q is great but I'm not sure I'd recommend it to friends and family.

I'm not a fan of DIY hardware wallets in general, IMO they're not as secure as a purpose built device.

That'd be really cool! I appreciate saving the list of installed apps as a file from Obtainium. Using nostr to save the list would make it even cooler! I could just log in with Amber on a new device to get my app set back. 🚀

The Tether business model is insane, surprised there aren't more attempts to copy it.

FWIW in my network N has 16 score, and I don't follow very many japanostr people