Hmm configuring public relays is new to me (blocking global feeds, filtering etc). Is there a manual / article for that?

How do I know which relays exist, and which to pick?

My experience with paid relays: I tried nostr .wine (18,888 sats) and eden .nostr .land (5000 sats) next to my 12 free relays (e.g. damus, nos) and it makes no noticeable difference. Wine is at least relaying many messages. Eden does absolutely nothing, zero messages relayed. So, idk, maybe I do something wrong here.. All tips/help is welcome!

After March 2024 halving, bitcoin will be the scarcest asset in the world.

Pefect match with the classic malts

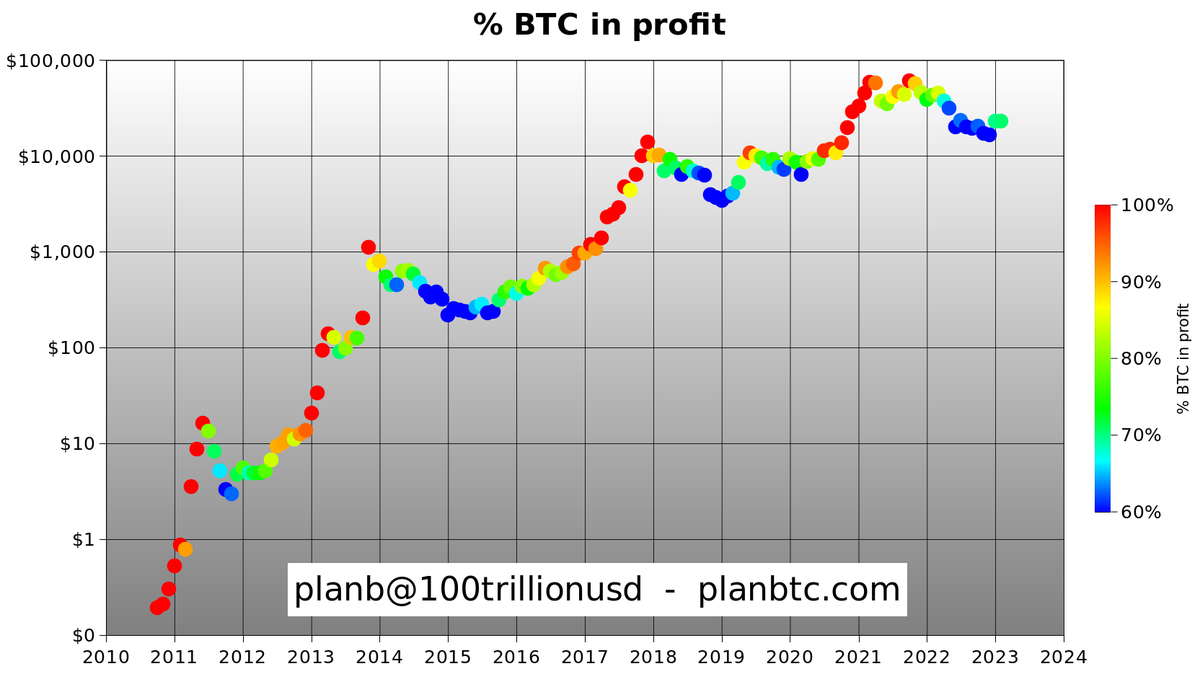

70% of all bitcoin is in profit. More detailed analysis:

https://www.youtube.com/watch?v=klUjoo-D-XY&t=12s

If bitcoin price jumped from $0 to $20k during 1% adoption .. then what will further adoption from 1% to 50% do with bitcoin price?

Ok, I payed 18,888 to nostr.wine and added wss://nostr.wine .. let's see what happens

Yup, no dm from eden.nostr.land

https://void.cat/d/2UzgmwsSrVPX6716BUPYub.webp

Relay list is on https://relay.exchange.

Hard to make recommendations because we don't have a lot of differentiation yet. nostr.wine is one of the few with some added features (the filter relay).

Hmm I just paid nostr.eden.land 5000 sats but nothing happens.. feels scammy

I am not using payed relays (only standard relays on iris and amethyst), should I and how does that work?

Bitcoin February closing price $23,145

Although I enjoyed bitcoin adoption last 10+ years (especially the investment returns), I am really looking forward to the vertical part of the S-curve in the next halving period (2024-2028)🚀

https://twitter.com/100trillionUSD/status/1630609627137163274

If bitcoin adoption is now 1-5% then we will enter the vertical of the S-curve next couple of years.

On log scale (left) this just means more exponential growth until 50% adoption. For the linear thinkers (right) everything will change. Bitcoin might be substantially undervalued.

https://twitter.com/100trillionUSD/status/1630572464051740680

2024 halving will make bitcoin the scarcest asset in the world. Even if we wanted to price that in, we couldn't.

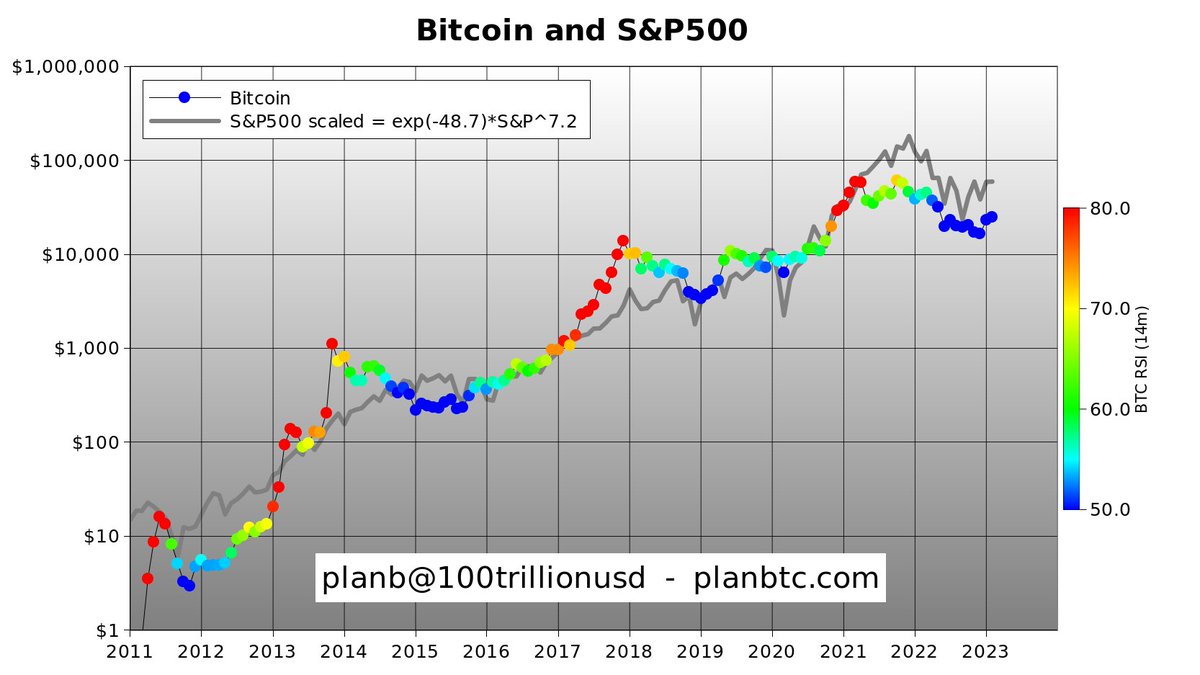

S&P500 is my macro proxy because stock markets price in / anticipate all macro events (inflation, recession, central bank action, war etc)

S&P500 is my macro proxy because stock markets price in / anticipate all macro events (inflation, recession, central bank action, war etc). More on S&P-BTC correlation here:

Yeah twitter is messing with my account, deleting/blocking ~200 random followers daily, and of course shadowbanned.

Stock-to-Flow model discussion:

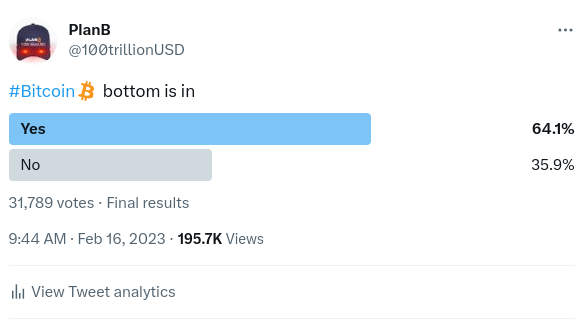

36% bears

Ok I tried the wos ln address now, thx!

I don't know how to implement that. There is a lnurl in my profile but guess that is not the way to do it...